Commercial Property Assessed Clean Energy is a financing tool that enables low-cost, long-term funding for energy efficiency, renewable energy, water efficiency, resilience, and public health to new and existing buildings.

ABOUT C-PACE

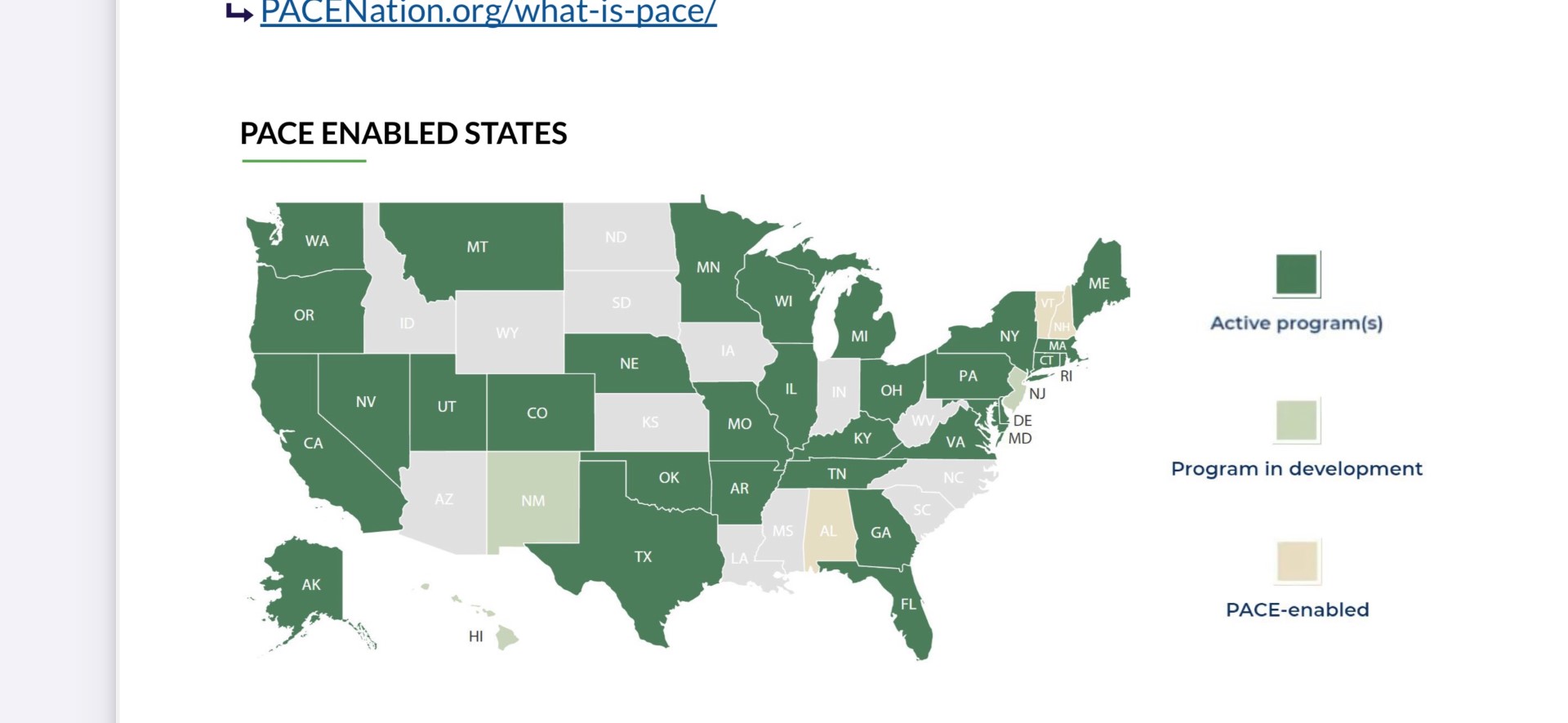

C-PACE is a public-private partnership that provides capital to increase building energy efficiency and to improve the systems and physical structure of commercial real estate properties. C-PACE is levied as a special assessment in the property records and repayments are made via an assessment on a property tax bill. C-PACE is currently available in more than half of the nation’s states, plus the District of Columbia, and is rapidly gaining legislative momentum in many more. C-PACE can finance building improvements for efficiency, renewable energy, and resiliency projects that contribute to energy and water savings. Applicable costs include, but are not limited to, heating/cooling HVAC improvements, interior and exterior lighting, building controls, windows, and in many instances, water efficiency measures. Light to heavy renovation, gut rehab, adaptive reuse, and ground-up development projects may all utilize C-PACE to improve capital efficiency and create a more effective capital stack.

Eligible Properties: Available for most commercial property types, including hospitality, industrial, office, retail, multifamily, agricultural, non-profit, and senior living and healthcare-related properties.

Terms: Long-term, fixed-rate financing, which provides predictability of borrowing by reducing carrying costs. Self-amortizing, fixed-rate loan with terms of generally 10 to 30 years.

Recourse: Non-recourse, non-accelerating, and does not require ongoing financial covenants. Loan is processed as a real estate tax and may be treated as a property expense.

Flexibility: Flexible prepayment options and operating flexibility upon sale of the property, as the remaining obligation may be transferred to the new buyer.

Lookback Features: Many jurisdictions have “lookback” features of 1 to 3 years, providing property owners the ability to access liquidity for energy efficient improvements already completed without refinancing the entire capital stack.

Geographic Area: Enabled by state legislation and at the local level by cities and counties. 30 states and Washington, D.C. have active programs. Residential PACE enabled in CA, FL, and MO. See map below to check your state’s eligibility.